indiana estate tax form

Use this form to initiate a property tax appeal with your Indiana county. Form to be filed by executors of an estate and other persons required to file Form 706 or Form 706-NA to report the final estate tax value of property distributed or to be distributed from the estate if the estate tax return is filed after July 2015.

Indiana Substitute for Form W-2 or Form 1099-R fill-in pdf W2 Filing.

. Inheritance Tax Forms If you and your staff are exhausted from spending endless hours typing correcting -- and retyping -- Indiana Inheritance Tax forms we have the solution. Inheritance tax applies to assets after they are passed on to a persons heirs. An Indiana small estate affidavit is used to gather the assets of a person who has died and left behind an estate worth less than 100000.

The estate tax rate is based on the value of the decedents entire taxable estate. If you have additional questions or concerns about estate planning and taxes contact an experienced Indianapolis estate planning attorney at Frank Kraft by calling 317 684-1100 to schedule an appointment. One Schedule A is provided to each.

Related

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return 2021 Form IT-40PNR State Form 472 R20 9-21 Due April 18 2022 Spouses Social Security Number Place X in box if you are married filing separately.

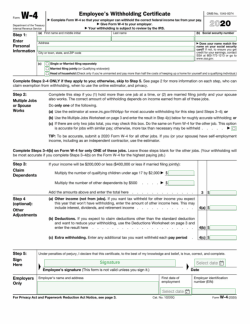

This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax. Many of the necessary determinations are done at the federal level by the IRS. You may even qualify to file online for free.

Step 3 Make a List of All Estate Items. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41. This list should include any real estate financial holdings banking accounts and personal property in the individuals possession.

Property taxes owed by the decedent. Use Form IT-40 if you and your spouse if married filing jointly were full-year Indiana residents. If you need to contact the IRS you can access its website.

Property tax forms are managed by the Indiana Department of Local Government Finance not the Department of Revenue. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Returns are processed faster refunds are issued in a matter of days and it is safe and secure.

Therefore you must complete federal Form 1041 US. Know when I will receive my tax refund. 56965 Motorsports Investment District Income - Team.

Complete revise and printing and indicator the attained Indiana Estate and Inheritance Tax Return Engagement Letter - 706. By making an organized list of all of the individuals property it. Signature of transferee Name typed or printed s s e r d d A.

Estate tax is one of two ways an estate may be taxed. Find Indiana tax forms. The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate.

If the decedent is a US. State Form 48832 R3 2-19 month year month year. Final individual federal and state income tax returns each due by tax day of the year following the individuals death.

However be sure you remember to file the following. Indiana Inheritance and Gift Tax. You may file a new Form WH-4.

Magnetic Media Filing for W2 W-2G and 1099R reports. The statements herein are true and correct to the best of such persons knowledge and belief. We last updated the Taxpayers Notice to Initiate a Property Tax Appeal in January 2022 so this is the latest version of Form 130 fully.

Individual Income Tax Forms. Her and is not subject to Indiana inheritance or estate tax and further says under the penalties for perjury that. Of all the states Connecticut has the highest exemption amount of 91 million.

48845 Employees Withholding Exemption County Status Certificate. Estate income tax through the fiduciary income tax return if more than 600 was made by the estate. Listed below are certain deductions and credits that are available to reduce a.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attrorney Forms. Therefore you must complete federal Form 1041 US. The affidavit cannot be filed earlier than forty-five 45 days after the date of death and must be signed in front of a notary public.

The tax rate ranges from 116 to 12 for 2022. APPLICATION FOR PROPERTY TAX EXEMPTION State Form 9284 R10 11-15 Prescribed by Department of Local Government Finance Assessment date January 1 20____ County Name of owner claiming exemption Address number and street city state and ZIP code LAND IMPROVEMENTS BUILDINGS Legal Description Assessed Value Description of Improvements. Form 8971 along with a copy of every Schedule A is used to report values to the IRS.

Level and file Form IT-41 at the Indiana level. A Current Assets List can be used when planning the distribution of an individuals estate. The easiest way to complete a filing is to file your individual income taxes online.

Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41. Ditional amount it should be submitted along with the regular state and county tax withholding. For more information please join us for an upcoming FREE seminar.

Individual Income Tax Forms. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. If you need to contact the IRS you can access its website at wwwirsgov to download forms and instructions.

Your Social Security Number Place X in box if applying for ITIN Place X in box if applying for ITIN. Federal estatetrust income tax. Take a look at the table below.

There is no inheritance tax in Indiana either. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. Citizen or resident and decedents death occurred in 2016 an estate tax return Form 706 must be filed if the gross estate of the decedent increased by the decedents adjusted taxable gifts.

Federal tax forms such as the 1040 or 1099 can be found on the IRS website. Form IT-40PNR for Part-Year and Full-Year Nonresidents Use Form IT-40PNR if you and your spouse if married filing jointly. The final income tax return of the decedent.

You can also order federal forms and publications by calling 1-800-TAX-FORM 800 829-3676. INDIANA PROPERTY TAX BENEFITS State Form 51781 R14 1-20 Prescribed by the Department of Local Government Finance THIS FORM MUST BE PRINTED ON GOLD OR YELLOW PAPER. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Starting in 2023 it will be a 12 fixed rate. Create a high quality document online now. There is also a tax called the inheritance tax.

Print or type your full name Social Security number or ITIN and home address. These taxes may include. Were Indiana residents for less than a full-year or not at all or Are filing jointly and one was a full-year Indiana resident and the.

More about the Indiana Form 130 Other TY 2021. Find individual tax forms and booklets with instructions below or at one of our district. Our award-winning Quick Easy automated forms software provides you with the most powerful reliable and effortless way to complete your legal forms transactions.

Property tax rebates for homeowners earning less than 250000 -- or 500000 if filing jointly -- will be available in an amount equal to the property tax credit they qualified for. Does Indiana Have an Inheritance Tax or Estate Tax. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Annual Withholding Tax Form Register and file this tax online via INTIME. Whereas the estate of the deceased is liable for the estate tax beneficiaries pay the inheritance tax.

How Long Does A Speeding Ticket Stay On Your Record D Turner Legal Llc Speeding Tickets Records Ticket

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Tax Form Templates 5 Free Examples Fill Customize Download

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Real Estate Tax Invoice Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Template Net Invoice Template Estate Tax Google Sheets

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Tax Form Templates 5 Free Examples Fill Customize Download

Web Living Accounting Humor Today Cartoon Taxes Humor

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Form 5695 Claiming Residential Energy Credits Jackson Hewitt

Wisconsin Quit Claim Deed Form 3 2003 Being A Landlord Quites The Deed

Form 1120 S U S Income Tax Return For An S Corporation Definition

Irs Form 945 How To Fill Out Irs Form 945 Gusto

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

When Is It Safe To Recycle Old Tax Records And Tax Returns